WORKING TOGETHER PAYS OFF

2020 was pivotal in spousal Social Security filing strategies because it brought the close of restricted spousal benefits as a filing strategy. If you are eligible and have not executed this spousal strategy, you are late, but not too late to start.

For years, spouses had an enormous opportunity to pick up a 50% spousal benefit from full retirement age (FRA) until 70 while delaying their own benefit for an 8% annual increase. It was so good, the government called it a loophole and took it away for anyone born after Jan 1, 1954. FRA is 66 for those born in 1943 to 1954.

In other words, if you are eligible and haven’t done a restricted spousal benefit by now, you are missing out.

To understand the impact, you need to have a general understanding of spousal Social Security options. A worker needs to earn enough credits, 40 to be exact, to qualify for a benefit on his/her own record. Four credits may be earned per year. Think of it as one per quarter, but the income doesn’t need to be earned in that quarter. “In 2021, you receive one credit for each $1,470 of earnings, up to the maximum of four credits per year.” https://www.ssa.gov/pubs/EN-05-10072.pdf

My wife worked for 8 years before choosing to stay home with our children. She has not yet qualified on her own record. Thankfully, she is still eligible for a Social Security benefit through my qualification. This is called a spousal benefit.

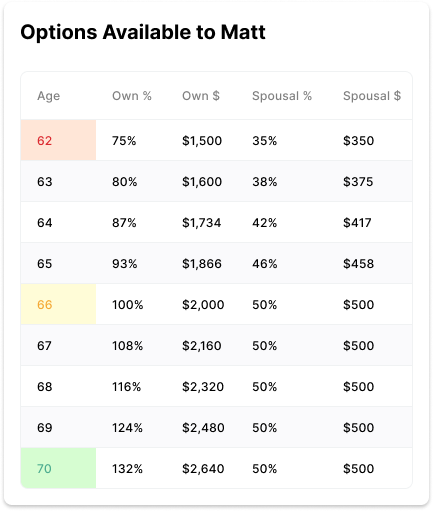

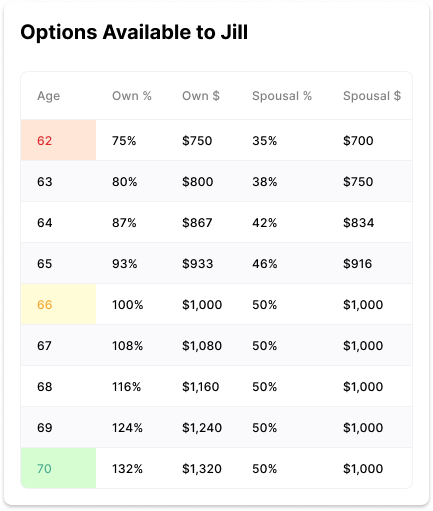

The amount is determined as a percentage of the primary workers benefit. The Social Security Administration (SSA) calculates a workers Primary Insurance Amount (PIA) which is just another way of saying, the amount you would get at your FRA. A spouse who is born in 1942 to 1954 is eligible for somewhere between 35% and 50% of his/her spouse’s PIA. The exact percentage will be set based on the age at which you elect your spousal benefit.

If Matt has a PIA of $2,000 and Jill has a PIA of $1,000:

How do Matt and Jill choose between all these many options?

For couples, Social Security filing is a team sport. Sometimes the question is not which benefit should I take. The question may be “In which order should I take benefits?” There can be strategies which allow you to elect one benefit and later switch to another.

The key considerations:

1. Survivor Benefits

2. Restricted Spousal Application Eligibility

3. Longevity & Breakeven Analysis

4. The Cost of Spending Your Own Money

HOW THEY WORK

The larger of the two benefits will be the payment the surviving spouse keeps if Matt or Jill died. The inverse is often erroneously ignored.

You should realize that the smaller of the two benefits disappears in the event of either spouse’s passing.

Let’s assume Jill had wonderful health and a family history of longevity and yet Matt had the opposite. Jill might determine she should wait on filing for Social Security given that she has read that if you live beyond low to mid 80s, you are better off waiting.

Now assume Matt, who had poor health, passes away in his 70s. Jill will take Matt’s benefit as a survivor and her benefit was mostly wasted. She may have only received a few years’ worth of it.

HOW IT WORKS

If one spouse was born on or before 1/1/1954, that spouse is eligible to apply to “restrict” to just the spousal benefit.

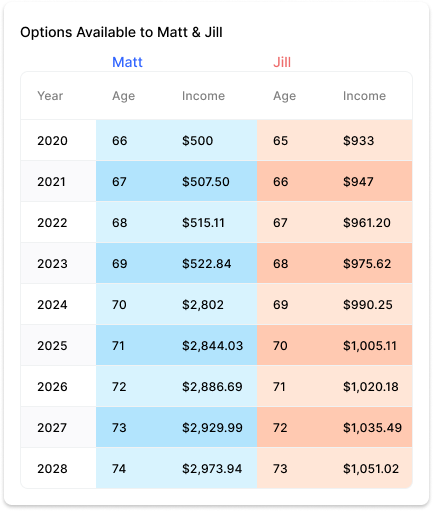

In the case of Matt and Jill, Matt was born in 1953 and Jill was born in later 1954. If Jill files for her own benefit, she opens the door for Matt to file for a restricted spousal benefit. At FRA, Matt is eligible for 50% of Jill’s PIA.

This allows Matt to let his own $2,000 benefit grow by 8% per year until 70. At 70, Matt will get $2,640 per month.

Likely, it will be more than that due to Cost of Living Adjustments (COLAs). More on that later.

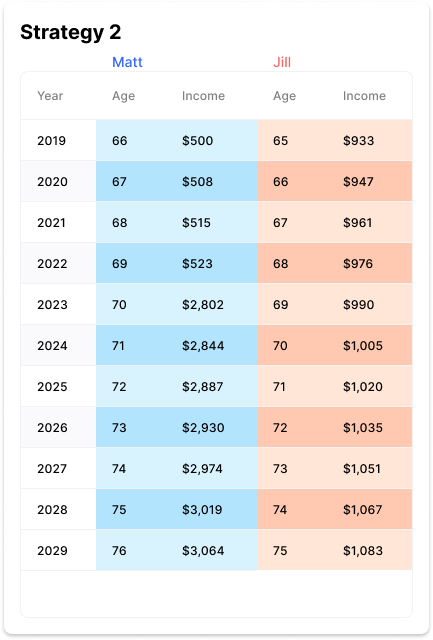

This spousal coordination monthly benefits would look like this, assuming a 1.5% COLA.

HOW IT WORKS

A breakeven analysis is when you determine the exact age at which two different strategies are equal.

If a spouse has good family health history, you should consider maximizing the survivor benefit for that spouse. This means delaying the larger of the two benefits.

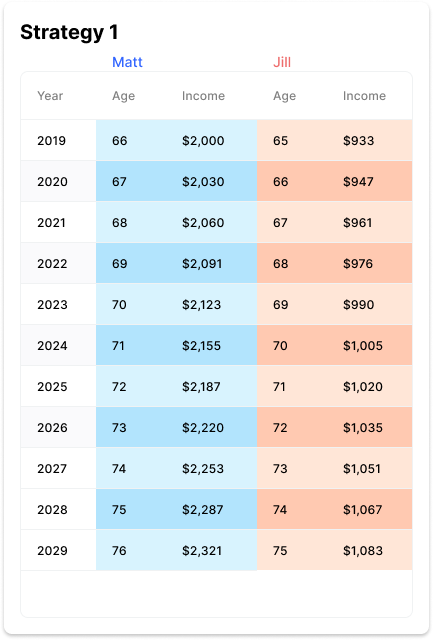

Notice the difference between Strategy 1 and Strategy 2 below.

Strategy 1 pays $1,500 less – as a couple – in monthly payments for the first 4 years.

Strategy 2 pays $700 more forever after 2023.

At what point does Strategy 2 catch up? The Breakeven is 2031, when Matt is 78 and Jill is 77.

AND WHAT IT MEANS

Most people fail to factor that a dollar today is worth more than a dollar in 15 years.

Intuitively that effect of inflation makes sense, but how should you consider inflation in your breakeven analysis?

First, Matt and Jill should assume some rate of increases on Social Security. Since 2008, the average has been 1.79%. Since 1985, the average has been 2.58%. https://www.ssa.gov/news/cola/

Consider using something conservative like 1.5%.

The more common mistake is comparing the 8% growth of Social Security with the modest rate of return one might see in their retirement accounts.

If you are retired, yet you choose to delay your Social Security to 70, you are likely withdrawing from your retirement accounts. Those withdrawals could have been avoided had you filed for Social Security earlier. That money could have earned some interest in your retirement account.

If you assume a rate of return on that money, you need to realize that Strategy 2 takes longer to make up the retirement account growth not experienced in addition to the Social Security money not received.

Matt and Jill need to live to 82 and 81 respectively if they can earn 5% in their portfolio to break even after both effects. You can see how your risk tolerance and growth rates will affect your true breakeven.

KEEP THESE IN MIND

If you have been married to someone for more than 10 years and that spouse has passed away, you may be eligible for survivor benefits as well.

I met Susan who had been married three times. She divorced George decades ago, Roger passed away, and she is currently married to Doyle. She has the option to take a survivor benefit using Roger’s earnings record starting at 60, a spousal benefit from Doyle starting between 62 and 70, or her own benefit starting between 62 and 70.

If she elects a spousal or her own benefit before her FRA, she will be locked in to that amount forever.

Here is what we plan to do:

• She will file for Roger’s survivor benefit at 60.

• If Doyle’s spousal benefit exceeds Roger’s survivor benefit at 66 (her FRA) we will switch to a spousal.

• Finally, at 70 she will get 132% of her own FRA.

Couples Social Security is a team sport.

Coordinate your benefits carefully.

Medicare & Social Security are complex, but you don’t have to deal with them by yourself. We’re here to do all the heavy lifting for you.

© 2024

NOT CONNECTED WITH OR ENDORSED BY THE UNITED STATES GOVERNMENT OR THE FEDERAL MEDICARE PROGRAM

90DaysFromRetirement.com is an educational resource. Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program. Calling our phone number will connect you to a licensed broker who is trained and certified to help you review the plan options available in your area. Currently we represent between zero (0) and nine (9) organizations which offer between zero (0) and fifty-two (52) products in your area. You can always contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program for help with plan choices.