You do not have to take Medicare at 65, but there are circumstances where if you don’t, you could face lifelong penalties – and nobody wants that.

When You Must Take Medicare to Avoid Penalties

When You Should Take Medicare, but Wouldn’t Necessarily have Penalties

Those covered by a company insurance plan do not need to take Medicare and they will not face penalties for postponing Medicare. However, if you work for a company with fewer than 20 employees, that complicates things.

This becomes a “who-pays-first” issue. Insurance regulations are set up in a way where if a company has fewer than 20 employees (19 or less), Medicare is the primary payor (pays first) and that company insurance plan moves into a secondary payor position.

If a healthcare bill goes to your company insurance company and you do not have Medicare, that insurance company can say, “wait a minute, we pay after Medicare is supposed to pay, so we aren’t going to pay anything until Medicare pays first.”

If you do not have Medicare, then you could be responsible for that entire charge.

This is why we recommend you take Medicare when eligible, even if you are covered by a company plan as long as your company has fewer than 20 employees. While you would not have a Part B or Part D penalty for delaying Medicare, you could be stuck with hefty medical costs.

When You Will Automatically be Signed up for Medicare

If you are taking Social Security Benefits prior to when you turn 65, you will automatically be signed up for Medicare Part A and Part B. You will get your Medicare card about 3 months prior to your 65th birthday.

Many people hope to continue working and stay covered on their employer plan, which they can do. If this is the case, you would potentially want to opt-out of Part B coverage to avoid paying for two insurance premiums – your company plan and Part B premiums – while you are still covered on your company plan. You would need to proactively opt-out of Part B, otherwise, you will automatically be signed up for Part B.

Sometimes your company plan is stronger than Medicare. Sometimes it’s not. Here’s what to look for when making the decision.

Part A Costs (2024)

Premiums

$0 – if you or your spouse worked for 40+ quarters throughout your life

$278 per month – if you worked for 30-39 quarters

$505 per month – if you worked less than 30 quarters

Deductible

$1,632 per benefit period

The Part A benefit period begins the day you are admitted as an inpatient in a hospital. This benefit period ends when you haven’t received any inpatient hospital care for 60 days in a row.

Hospital Copays

$408 per day

For days 61-90 in the hospital.

$816 per day

For days 91-150 in the hospital.

Skilled Nursing Copays

$204 per day

For days 21-100.

You are responsible for 100%

For days 101+.

Part B Costs (2023)

Premiums

$174.70

This is the base premium. Those with higher incomes will pay more (see chart).

Deductible

$240 per year

This is an annual deductible and represents the dollar amount you must pay first for any Part B charge before Medicare starts to help out.

Coinsurance

20% – No Max

Once your Part B deductible is met, you are responsible for 20% of all Part B expenses. There is no out of pocket maximum on this risk, which is why many people choose to get a Medicare Supplement plan or a Medicare Advantage plan (Step 9).

Part D Costs (2024)

Premiums

Varies – Average is $55.50 per month

Deductibles, Copays, and Coinsurance Amounts

See the Part D Deep Dive in the Extras

There are specific windows of time where you can sign up for Medicare. Don’t ignore these windows or you could find yourself dealing with gaps in coverage, penalties, or both.

ENROLL IN PARTS A, B, C, & D

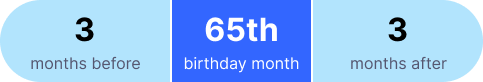

The Initial Enrollment Period is the window in which you first qualify for Medicare. It is a 7-month window that starts 3 months before your 65th birthday, includes your 65th birthday month, and extends 3 months after your 65th birthday month.

Initial Enrollment Period Window

OUTSIDE THE INITIAL ENROLLMENT PERIOD

The Special Election Period is available for 63 days following certain qualifying events such as moving outside your plan coverage area or, the most common event – the loss of employer group health coverage.

JANUARY 1 TO MARCH 31 OF EACH YEAR

The General Enrollment Period is for those who did not enroll in Part B during their Initial Enrollment Period, nor did they enroll during a Special Election Period.

If you enroll during the General Enrollment Period, your coverage begins on July 1st of that year. This means that you may be without Part B coverage for 3 months or longer and subject to penalties.

BASED ON YOUR PART B EFFECTIVE DATE

The enrollment window for Medicare Supplement plans begins on your Part B effective date and ends on the last day of the 6th month after your Part B effective date. This is called the Medicare Supplement Open Enrollment Period and is the only time you can enroll in Medicare Supplement plans where you won’t be asked medical questions. You are guaranteed to be issued a Supplement plan if you enroll in this window.

You can start the enrollment process into a Supplement plan before your Part B effective date, in fact, we highly recommend you do so 90 days before you plan on needing the benefits. We would simply set your Supplement start date to be the same as your Part B effective date.

Medicare & Social Security are complex, but you don’t have to deal with them by yourself. We’re here to do all the heavy lifting for you.

© 2024

NOT CONNECTED WITH OR ENDORSED BY THE UNITED STATES GOVERNMENT OR THE FEDERAL MEDICARE PROGRAM

90DaysFromRetirement.com is an educational resource. Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program. Calling our phone number will connect you to a licensed broker who is trained and certified to help you review the plan options available in your area. Currently we represent between zero (0) and nine (9) organizations which offer between zero (0) and fifty-two (52) products in your area. You can always contact Medicare.gov, 1-800-MEDICARE, or your local State Health Insurance Program for help with plan choices.